33+ oklahoma paycheck tax calculator

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Sign Up Today And Join The Team.

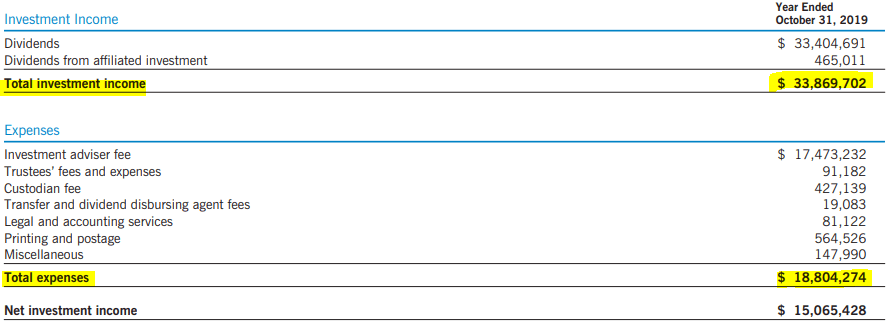

Ety 10 Yielding Cef But We Are Concerned About The Second Wave Of Coronavirus Infections Nyse Ety Seeking Alpha

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

. Calculate take home pay after taxes deductions and exemptions. For annual salary hourly wage and self-employed. Web If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Web Oklahoma Bonus Tax Percent Calculator Change state This Oklahoma bonus tax calculator uses supplemental tax rates to calculate withholding on special wage. Web Income tax 05 - 5. Web If you make 55000 a year living in the region of Oklahoma USA you will be taxed 11198.

Sign Up Today And Join The Team. The OK Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

Web With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. How is Oklahoma withholding tax calculated. Web Payroll check calculator is updated for payroll year 2023 and new W4.

Learn About Payroll Tax Systems. Web Calculating your Oklahoma state income tax is similar to the steps we listed on our Federal paycheck calculator. Get Your Quote Today with SurePayroll.

Get Started Today with 1 Month Free. Ad Payroll So Easy You Can Set It Up Run It Yourself. Web Updated for 2023 tax year.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Heres how to calculate it. Web To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web The Oklahoma salary calculator will calculate how much income tax you will pay each paycheck. Web What is the income tax rate in Oklahoma.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. That means that your net pay will be 43041 per year or 3587 per month. Have your employees complete Form OK-W-4 Employees State Withholding.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Web The Oklahoma Income Tax Calculator Estimate Your Federal and Oklahoma Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Salary Paycheck Calculator Oklahoma Paycheck Calculator Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Tax rates range from 025 to 475. If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2000 and other dependents by 500. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

The state income tax rate in Oklahoma is progressive and ranges from 025 to 475 while federal income tax rates range from. Nine states dont tax employees and. Web The Oklahoma tax calculator is updated for the 202324 tax year.

Web Oklahoma state payroll taxes FAQ 1. Single filers will pay. Over 700000 Businesses Utilize Our Fast Easy Payroll.

States have the right to impose their own taxes on residents and non-residents with nexus to the state. Hourly employees who work overtime. Web The minimum wage in Oklahoma is whatever the minimum wage is at the federal level which is currently 725 per hour.

After a few seconds you will be provided with. Figure out your filing status work out your adjusted. That means that your net pay will be 43803 per year or 3650 per month.

States have no income tax. Learn About Payroll Tax Systems. Over 700000 Businesses Utilize Our Fast Easy Payroll.

All Services Backed by Tax Guarantee.

Doc My Dissertation Approval Of George W Bush Economic And Media Impacts Gino Tozzi Academia Edu

Paycheck Calculator What Is My Take Home Pay After Taxes In 2019

New Tax Law Take Home Pay Calculator For 75 000 Salary

Goe Allocation Presentation

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Paycheck Calculator Take Home Pay Calculator

Academic Information Jamestown Community College

Tennessee Paycheck Calculator Smartasset

Download Genome Biology And Evolution

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Pdf The People And Me Michael Moore And The Politics Of Political Documentary Scott Oberacker Academia Edu

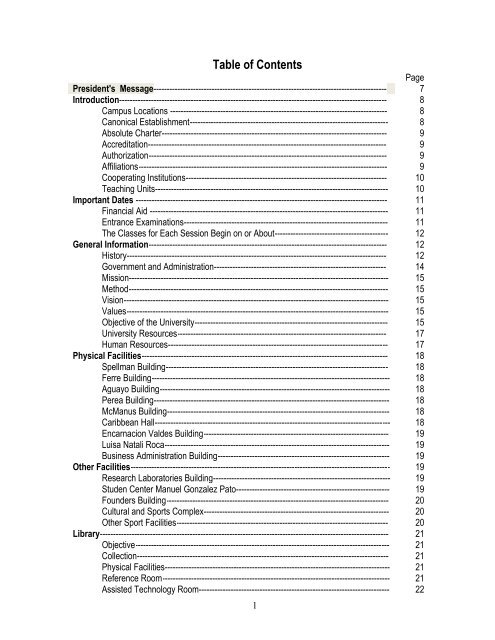

Table Of Contents Pontificia Universidad Catolica De Puerto Rico

Oklahoma Paycheck Calculator Smartasset

33 Sample Professional Services Agreement In Pdf Ms Word

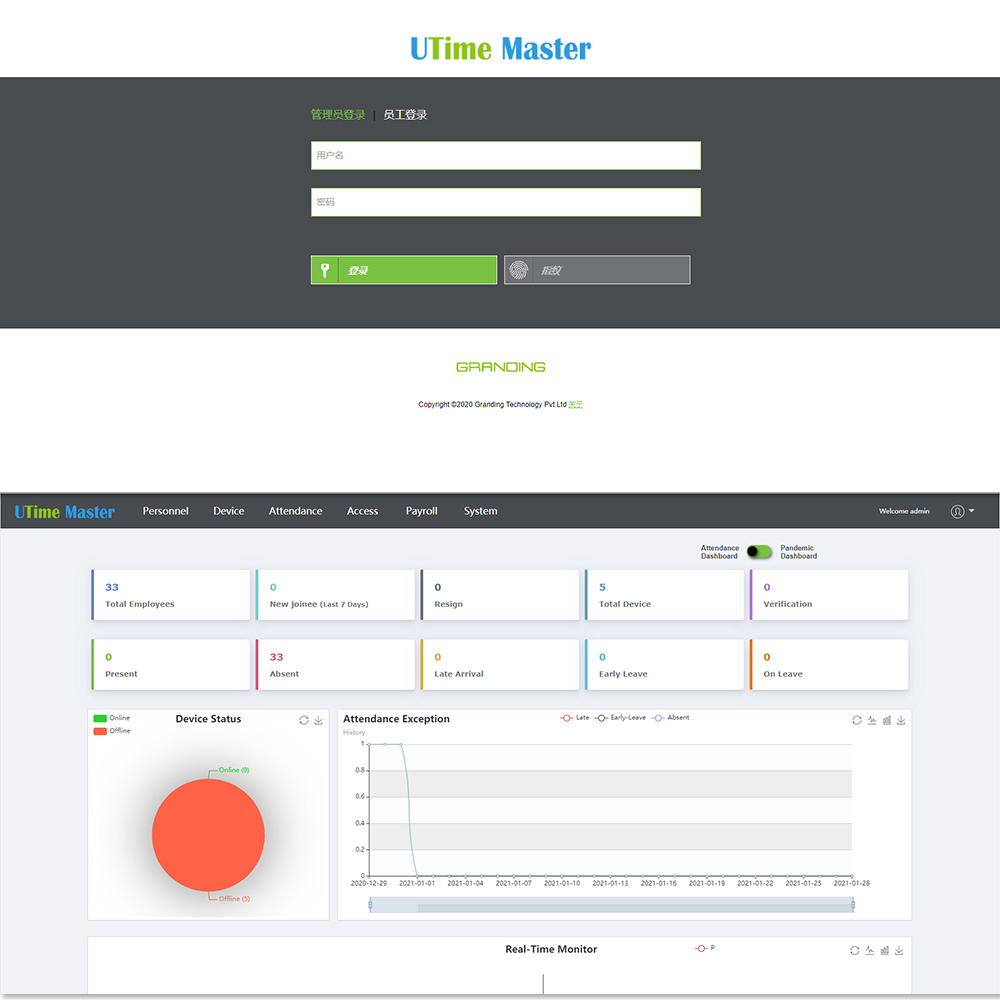

China Utime Master Web Based Powerful Time And Attendance Software With Attendance Management Access Control Payroll And Mobile App Factory And Suppliers Granding

Oklahoma Payroll Paycheck Calculator Oklahoma Payroll Taxes Payroll Services Ok Salary Calculator

Gross Pay Net Pay